In general, the oil and gas industry is risk averse. Given the serious economic, environmental, and societal consequences that can result from an incident, facility management is typically conservative in how they calculate risk and make risk management decisions. However, facilities must accept some level of risk in order to operate and capturing this level of acceptable risk is key. This blog will discuss how facilities can overcome these challenges by focusing on quality data, analyses, and decision-making processes.

The Origins of Risk-Based Inspection (RBI)

While the oil and gas industry really took off in the 1850s with the establishment of the first refinery and oil well, it wasn’t until about 100 years later that the industry truly started to focus on proactively managing risk. Prior to the 1950s, the industry embraced a “run it until it breaks” approach. Facilities in the 1960s-70s began conducting inspections at regular intervals until the 1980s, when the industry started to shift to an approach that conducted inspections based on an equipment’s condition. This concept carried over to the 90s when conducting inspections at a fixed interval was still the norm.

Finally, in the early 2000s, amid an energy crisis (and perhaps out of necessity), the industry slowly but surely started to shift to a more risk-based approach to inspection. This approach balanced the condition of the equipment with the consequences of the failure of that piece of equipment.

Are Refineries Leaner and Meaner?

Has Risk-Based Inspection (RBI) had an impact? You be the judge. In 1980 there were around 300 US refineries. Today, there are about 130. However, even with less than half of the facilities in the 1980s, crude oil is still being processed at the same capacity. Why? Because refineries are operating more reliably, even though there’s still room for improvement.

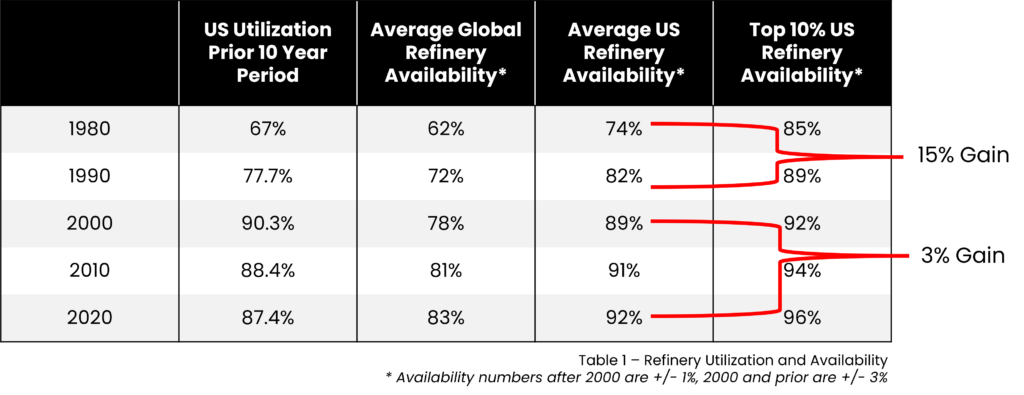

Looking at the table below, we see large jumps in the average availability and utilization (15% gain) for US refineries between 1980-2000; however, looking at 2000-2020, there is a much smaller increase at only 3%. While numerous factors impact a refinery’s utilization and availability, as refiners operate with less downtime, it becomes more difficult to make impactful improvements with current methodologies and models.

Establishing an Effective Reliability Program

While the industry has made significant advancements over the past couple of decades, this slower increase in the growth of utilization shows that we need better risk models. Douglas Hubbard, an expert on risk management, gives four primary reasons why risk models fall short across multiple industries, including oil and gas.

Models can be too dependent on expert input

Expert opinion, unfortunately, often has decision biases.

Models aren’t always validated against what happens in the field

If no one challenges the model, and whether or not it’s accurate, there’s a chance that the risk model will be inaccurate.

Models can be siloed

Sometimes, especially in complex systems, various factors can cause risk models to go askew, and if our models aren’t considering those things, the risk models might fail.

Models aren’t always used by people with shared incentives

For example, a fixed equipment engineer who is motivated to not let a leak occur may skew the risk models to be conservative.

Better RBI Models = Better ROI

Even refineries operating at high levels of availability can recognize significant economic benefits from better risk models. For example, a 2% increase in availability and utilization across US refineries equates to about $1.5 billion annually. If these same refineries recognized a 10% reduction in the maintenance and turnaround costs associated with inspection, this would also equate to about $1.5 billion annually.

It’s obvious that there’s value in building better models, but how do we achieve this? Better risk models should:

Validate against actual results

Better use data

Minimize the impact of human bias

Separate degradation and uncertainty

Evaluate the entire system, not just one asset alone

As an industry, we must start thinking differently if we want to realize the massive economic gains and safety impacts that exist. We can’t continue to solve the problems of the 2020s using the solutions we had in the ‘80s and ‘90s.

To dive deeper into the evolution of risk models, check out this video presentation led by CEO, Ryan Sitton, and Lynne Kaley, Vice President, Research and Development.

Stay in the know.

Providing data-driven insights, perspectives, and industrial inspiration from the forefront of the reliability transformation.