How much influence does reliability have on the profitability and performance of a refinery? Refineries that anchor reliability into their operational strategy often recognize profitability gains and can leverage their resources more effectively. Inversely, refineries that do not operate reliably often experience significant financial and safety challenges. Even the perception of a company underperforming in reliability or safety can result in serious financial implications, such as the downgrading of their stock.

Historically, it’s been difficult for refiners to parse out specific reliability metrics to determine the impact of reliability on profitability. However, in our second Economics of Reliability Report for the refining industry, we begin to tease out reliability performance as a standalone metric by analyzing the 2017 – 2022 financial and operational data of 19 downstream companies such as bp, ExxonMobil, and Valero.

We sat down with Lewis Makin, partner at Pinnacle, and Jennifer Lawrence, Lead at Pinnacle, to further examine how reliability impacts a refiner’s profitability and discuss which operator in our selected group of 19 companies is the most reliable.

How are refineries talking about reliability? Is there a difference between how reliability is being prioritized at the plant level vs. the corporate level? If so, how has the industry’s approach to reliability evolved over time?

JL: You may be hard-pressed to review a transcript of a refiner’s earnings call and not find a CEO who refers to reliability. In some cases, executives credit reliability for enabling their company for being able to take advantage of the recent high-priced environment and driving high refinery margins. Other executives reference the need for their company to improve and optimize reliability. Executives have made the connection that the cost of not performing reliably is high not only from a profitability standpoint but also from a process safety standpoint. The everyday maintenance, inspection, and safety tasks that are handled at the plant level are absolutely critical to business outcomes and shareholder confidence.

Additionally, the methodologies, priorities, and spend at the plant level can vary greatly, and as a result, so can the outcomes and the way different levels of the organization prioritize reliability. At the plant level, significant focus is spent on the reliability of the asset, while at the corporate level, reliability is often measured across its impact on multiple business units. The best refiners prioritize reliability at the C-suite, allowing for centralized, consistent solutions that focus on performance across the business units.

How did the 19 refiners in our report perform? What qualities do you typically see in the top performers?

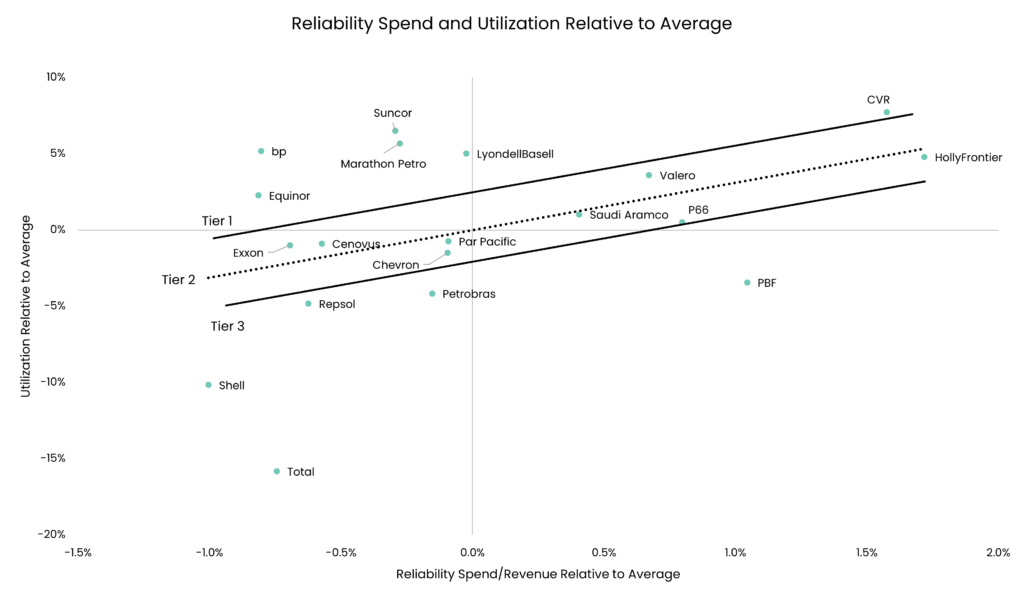

LM: We identified three tiers of operators in our report. The first tier, which is the highest performing operators, has higher than average utilization combined with a generally lower than average reliability spend level relative to revenue; these companies likely have efficient and effective maintenance and reliability programs. The third tier of operators is the lowest performers in our cohort. Refiners in this tier have lower than average utilization and generally lower than average reliability spend; companies that fall within this range should likely increase their level of reliability spending to help increase utilization to capture current strong margins. In the middle of the range are operators who fall marginally along the trendline between utilization and reliability spend. Two types of operators exist in Tier 2 – those with lower-than-average reliability spend and slightly lower than average utilization and companies with higher than average spend rates and slightly higher than average utilization. The first type of operator in Tier 2 should increase reliability spend slightly, while the second type of Tier 2 operator should employ a data-driven approach to identify any wasted spend in their maintenance programs. Some companies that operate in a Tier 1 environment are bp, Suncor, Marathon, and Equinor. Tier 2 operators in our analysis are ExxonMobil, Cenovus, Chevron, Par Pacific, Saudi Aramco, Valero, and HollyFrontier. The operators that were identified as the poorest performers in terms of reliability and utilization were TotalEnergies, Shell, Repsol, Petrobas, and PBF.

JL: The deep dive into the 19 refiners in our report shows us that utilization and the cost of feedstock are the most impactful on refining profitability in our current climate. Our categorization of tiered performers is tied to their corresponding utilization rates and reliability spend. I find it interesting that two of the companies that are identified as Tier 1 reliability performers, Suncor and LyondellBasell, are in the news despite their Tier 1 performance. Lyondell is essentially getting out of the refining business, and Suncor has been wrought with safety issues related to its operations. Even if an operator is a Tier 1 performer, there is a limit to the impact that asset performance can have on economics that outweighs the negative impact of safety incidents enabled by potentially underfunded reliability programs.

We see in our report that there is a “sweet spot “ for refiners to hit in order to achieve the optimal amount of return on their investment. What is this “sweet spot”? How can refiners know that they are hitting it?

JL: Once a refiner can accurately estimate operations spend and its impact on future utilization targets, then we can apply financial models to figure out what their specific sweet spot is. Until recently, the industry hasn’t really been in a position to be able to model future utilization with varying scenarios of operational spend related to asset management. The next evolution of reliability, what we are calling Data-Driven Reliability, is enabling those types of utilization models to be realized today. For example, imagine being a refiner in the Tier 3 category of our study with the goal of becoming a Tier 1 operator. To achieve this goal, this refiner will need to set utilization targets, assess revenue gains, identify the cost of operations, and have its operations plans align with utilization targets. Once the operator accomplishes these objectives, they can then use this information to make strategic decisions that will improve profitability.

LM: There is not one single “sweet spot” for individual refiners to hit in terms of the amount spent on reliability. Different operations require different investments and upkeep; older assets may require more maintenance than newer assets. However, there are some takeaways that we gathered from our report that we could use as guidelines for the industry. For example, the average reliability spend in our analysis was 2% of annual revenue. As previously mentioned, there is a slight positive correlation between reliability spend and refinery utilization. Using average reliability spend levels gives us a general guideline of what companies should be shooting for in terms of how much money to invest in operations. However, this is going to differ from company to company – if a company cuts spend levels and faces operational difficulties, that is a sign that its maintenance should be more intensive. Operators with a high spend level should review their maintenance programs and use high-integrity data to identify areas where spending can be reduced.

For further insight into the impact of reliability on the refining industry, download our Economics of Reliability Report or watch the below clip from our Economics of Reliability Roundtable.

Stay in the know.

Providing data-driven insights, perspectives, and industrial inspiration from the forefront of the reliability transformation.