Whether facing the increasing pressure to transition to environmentally friendly operations or navigating the fluctuating supply of crude oil, the decisions of refinery management teams carry greater weight than ever. However, despite the ongoing challenges that the industry is facing, refiners are in a unique position to capitalize on the current market.

Interestingly, many refiners are not capitalizing on this opportunity. Regardless of the major tailwinds that typically result in large profits, refineries that do not operate reliably are not as profitable as they could be.

How much of an impact does reliability have on the profitability of refineries? To investigate, we analyzed the 2017 – 2022 financial and operational data of 19 downstream companies in our second Economics of Reliability Report for the refining industry. Additionally, we sat down with Jace Thurman, Market & Data Analyst at Pinnacle, and Jennifer Lawrence, Lead at Pinnacle, to discuss the report and get their thoughts on how refiners can pivot their operations to combat fluctuating supply and demand.

How is the Russia/Ukraine war impacting the refining industry, specifically the production of crude and natural gas? Are there any specific factors that this war is impacting besides feedstock? How can refiners pivot their operations to combat fluctuating supply and demand?

JL: With limited feedstock available to the refining industry due to the Russia/Ukraine conflict, the US has been offering millions of barrels of oil from its Strategic Petroleum Reserve. However, the reserves’ releases are scheduled to stop at the end of October, at which time the reserve will shrink to a 40-year low. Obviously, the world can’t keep relying on the US strategic reserve to keep oil prices in check and meet demand. We have a finite amount of available crude oil, and the depletion of the reserve poses a risk to our national security. It’s also worth noting that while any barrel of crude is better than no barrel of crude, not all crude is the same. What has been sold off from the reserve is mostly what is known as medium-sour crude, a fan favorite for domestic refiners. Russia was a major contributor of this medium-sour crude, and this type of crude could run out in the next four to five months if we keep selling it at the current rate beyond the October threshold. Without the reserve or Russia to supply this type of crude, refiners could be left with heavier, albeit cheaper, crude. With a steady diet of heavier, cheaper crudes, refiners will have to pivot by potentially investing in upgrading their processes to produce the same higher-value products they can get from using the lighter crudes. The costs and payback period for these upgrades can potentially be offset by improving the overall reliability of the assets by increasing availability and throughput. While many refiners have perfected reliability in their traditional forms to maximize asset performance and life cycle costs, a new evolution in reliability is warranted – one we’re calling data-driven reliability. This approach to reliability offers facilities a framework that can help them achieve additional performance improvements and pivot to meet demand utilizing a less than perfect feedstock.

JT: The price of petroleum products has, as drivers are well aware of every time they fill up their gas tanks, steadily increased since November 2020. Increasing consumer demand and overall economic inflation were the root causes of higher prices; when Russia invaded Ukraine in February of 2022, the global trade flow for crude oil was disrupted. Russia is a significant exporter of crude oil and natural gas, contributing 8.3% of crude exports in 2021 and 8.2% of liquified natural gas exports in 2020 (Statista, BP World Factbook). In response to the military action, foreign governments and oil corporations responded by imposing sanctions on Russia and ceasing operations in the state. Some countries banned the imports of Russian oil products. This impact on the global oil trade added tailwinds to already increasing crude and natural gas prices, and refineries have been forced to pay higher prices for crude feedstock. Interestingly, even though refiners are forking over more cash for their feedstock, higher petroleum derivatives pricing and demand have led to wider margins and larger profits. Outside of the fact that refineries have been paying higher prices for crude, procuring barrels of oil has been more of a challenge. Import restrictions in the US and other countries have forced refineries to rethink their crude purchasing strategy. For example, refineries on the west coast of the US have historically imported Russian crude; they are now shifting their purchases to Canadian and Latin American imports. The opposite problem is actually occurring in Russia; refineries in Russia have ramped down production because of a supply gut of domestic crude oil.

The current energy market conditions are incentivizing refineries to maximize utilization and production. The past three years, however, have been turbulent for oil supply and demand; having reliable operations can help refineries combat lower and higher demand. Being able to reliably and efficiently turn production up and down based on market conditions will allow refineries to minimize expenses and capture wide margins.

As corporations face increasing pressure – both from their stakeholders and the global economy – to transition to environmentally friendly operations, how does reliability play a role in this transition?

JL: It will be a long while (if ever) before we get completely away from fossil fuels. With that being said, there is no runway ahead for continued increases in fossil fuel demand. The demand for fossil fuels has risen continually since the first refineries were built more than one hundred years ago, and that demand could peak soon if it has not already. Because of this, some refiners are retrofitting traditional refining assets to produce renewable diesel and other biofuels. Reliability will certainly play a role in these asset conversions to help align assets to new performance objectives. Reliability will also pave the way for increased throughput and capacity to meet existing demand in a limited refining asset base as data-driven reliability methodologies are adopted to enhance traditional methods.

JT: Recent focus on refinery throughput and capacity has put a spotlight on oil and gas management teams. COVID-19-related capital discipline and political and stakeholder pressure to transition to clean energy and renewable fuels have led corporations to limit their investment in new refinery expansions and upgrades. Investors are keenly aware that the world is pushing toward environmental initiatives. This awareness has influenced corporate strategy and even led management teams to provide financial incentives for executives who successfully make ESG-related changes. The economic cost of intense investments in refineries is not as attractive as other opportunities due to the long-term return on investment and uncertain market conditions. Reliability is an effective tool that refineries can use to ensure that operations run smoothly and effectively. Since refineries are not expanding or investing large amounts of capital into assets that will increase throughput, management teams should focus on ensuring that current assets have an efficient and effective maintenance program to ensure reliable operations.

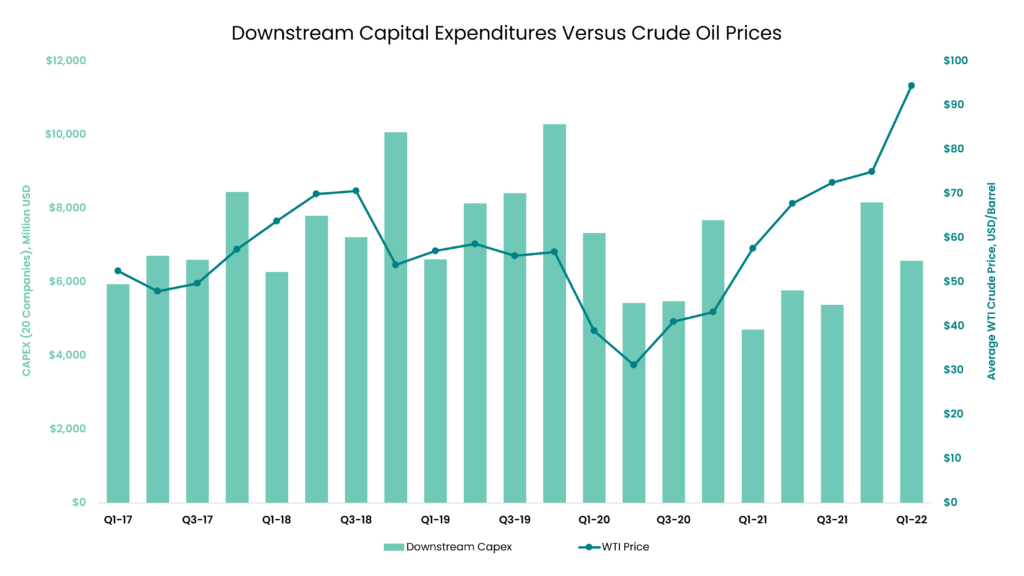

The graph below shows WTI crude price and downstream capital expenditures for the 19 companies we studied in our report on a quarterly basis. Crude prices in the first quarter of 2022 have continued the upward trend experienced since the low in the second quarter of 2020. Capital expenditures in the first quarter of 2022 did increase compared to the prior year but are still below the levels reported for the first quarter of 2019 and 2020. Because of the complexity of refining operations, management teams would benefit from employing a data-driven approach to identify the most effective and efficient use of future capital.

In April, LyondellBasell announced that it would cease operations at its Houston Refinery, one of the largest refineries in the US, by the end of 2023. Plans to convert the refinery to a plastics recycling facility are reportedly being discussed. Any thoughts/ideas as to why LyondellBasell made this decision?

JT: The Houston refinery has struggled to perform reliably and safely for a while, and this has impacted its profitability. The refinery reported operating losses for the past six years (Houston Chronicle). This year’s market conditions have made the facility profitable, but LyondellBasell is still pursuing plans to cease operations. One potential reason is that the refinery was built to be a supplier of their petrochemical operations, which is the main source of revenue for the company and its strategic focus. The fact that the refinery is seemingly not a priority has led to underinvestment; the plant would require significant investment to bring it to a state-of-the-art facility. Executives at the company have said they are considering turning the refinery into a plastic recycling site to facilitate their chemical portfolio.

For further insight into the impact of reliability on the refining industry, download our Economics of Reliability Report or watch the below clip from our Economics of Reliability Roundtable.

Stay in the know.

Providing data-driven insights, perspectives, and industrial inspiration from the forefront of the reliability transformation.