As the global supply and cost of energy continue to fluctuate, and a potential recession looms in the near future, many are looking to the performance of the oil and gas industry to get some sense of how the future economy will perform. Global challenges such as Russia’s ongoing threats to shut down critical natural gas pipelines connected to Europe have highlighted the global dependency on the midstream segment of the oil and gas industry. Additionally, in May 2022, the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) released a final rule which requires pipeline operators to report safety information for all gas gathering lines. This final rule further increased the industry’s focus on pipeline safety.

As midstream operators face increased pressure to transport and store available commodities, the reliability of their assets has become even more critical to the success of the industry and global economy. With this heighted focus on the midstream industry, we released our first Economics of Reliability Report-Midstream Industry. In this report, we analyze the operational and financial data of publicly traded midstream operators headquartered in the US and Canada.

We sat down with Jace Thurman, Market & Data Analyst at Pinnacle, and Austin Laskey, Partner at Pinnacle, to further explore the report and discuss how reliability impacts the midstream industry.

What impact have you seen reliability have on midstream operators? When reliability is or isn’t being prioritized, what does an operator in the midstream industry experience?

AL: Having strong reliability foundations in place from start-up is critical to maintaining sustainable, efficient operations. We’re currently working with a midstream service provider as they prepare to get one of their greenfield facilities up and running. This company is now investing in many new facilities and wants to ensure its assets are operating as efficiently and effectively as possible from start-up. Additionally, this company is currently spending a large amount of its reliability budget on sustaining capital investments. While we’ve seen this type of heavy investment into reliability initiatives pay off for our customers with greenfield facilities, facilities need to be careful that they are not wasting money on inefficient reliability programs. Facilities looking to have more efficient reliability programs should identify the highest value tasks and eliminate routine processes that only happen because the programs were historically set up that way.

How does the performance of the midstream operators we studied in the report compare to one another?

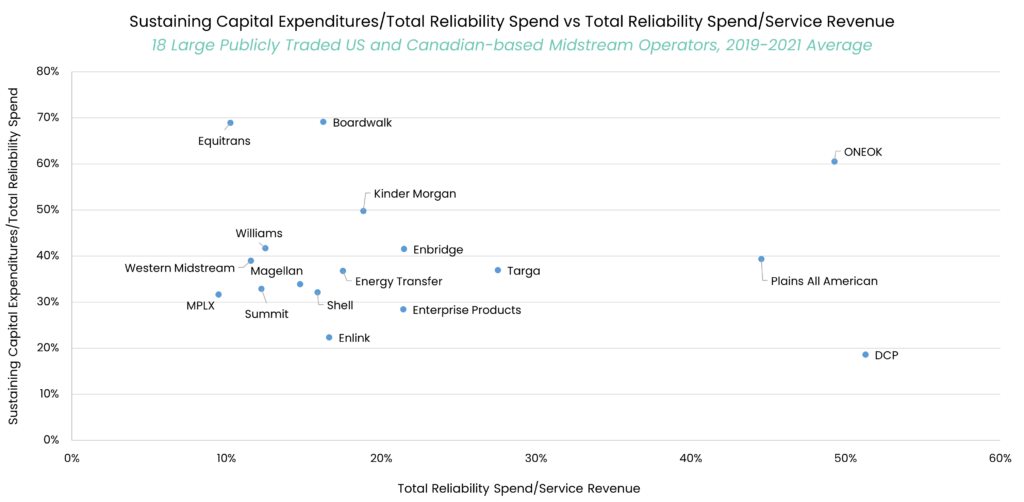

JT: In our Economics of Reliability report for US and Canadian Midstream Oil & Gas, the scatter plot shows two things, with all data averaged from a 3-year period from 2019 to 2021. First, the y-axis shows the fraction of reliability spend that is capitalized. A portion of companies breaks out their capital expenditures between “growth” and “sustaining” capital. Growth capital expenditures are those that are expected to increase production or revenue. Sustaining capital expenditures are those that maintain current levels of production or revenue. We define sustaining capital expenditures as one type of “reliability spend,” with the second type of reliability spend being expensed. The further up you go on the y-axis, the higher the fraction of reliability spend that is capitalized rather than expensed. This is intended to show the financial reporting methodology of the various companies. Second, the x-axis shows the total reliability spend relative to service revenue. Many midstream companies derive a significant portion of their annual revenue from the sale of hydrocarbons; to focus on revenue that is generated from productive assets, we stripped out any non-service revenue. The further to the right you go on the x-axis, the higher the percentage of service revenue that a company spends on reliability measures, such as improving asset integrity or replacing aging pipelines.

AL: In our report, we highlighted 17 large, publicly-traded US and Canada-based midstream operators. On average, these companies spend 19% of service revenue on reliability initiatives. While most of the companies fall within a small range on either side of this average, a few companies significantly diverge from the average. ONEOK, Plains All American, and DCP Midstream spend between 45-51% of service revenue on reliability programs; this is significantly higher than any other company in our report, with the 4th highest spender averaging ~27% of service revenue on reliability. These three companies most likely have some level of waste in their reliability initiatives and would benefit from examining their spending habits and identifying and eliminating this waste. Other companies, such as MPLX and Equitrans, have lower than average spend. This suggests that these companies have underinvested in their equipment, and this could have significant consequences in the near future, especially if upstream operators begin increasing production and exploration of crude.

What are some practical takeaways from the report? How can midstream operators use this report?

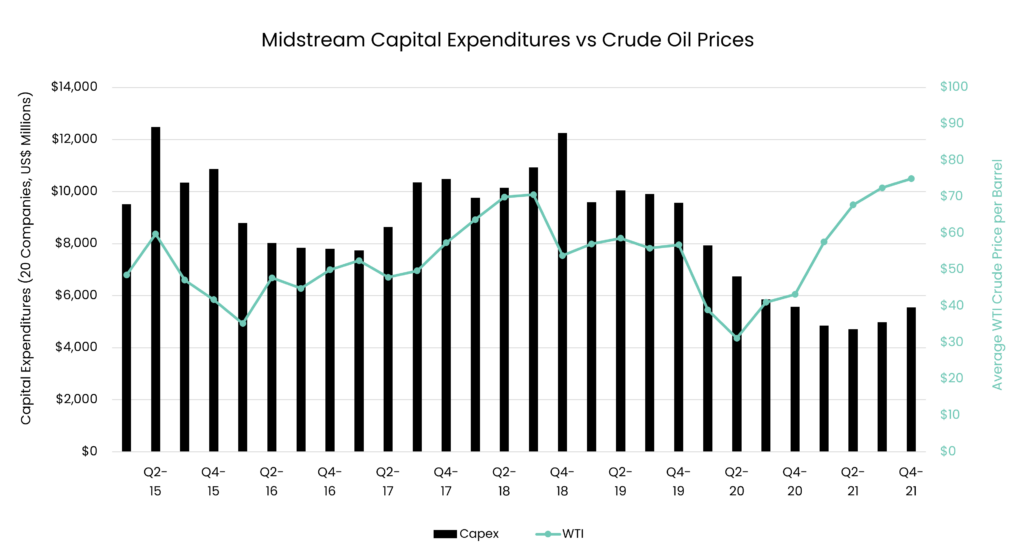

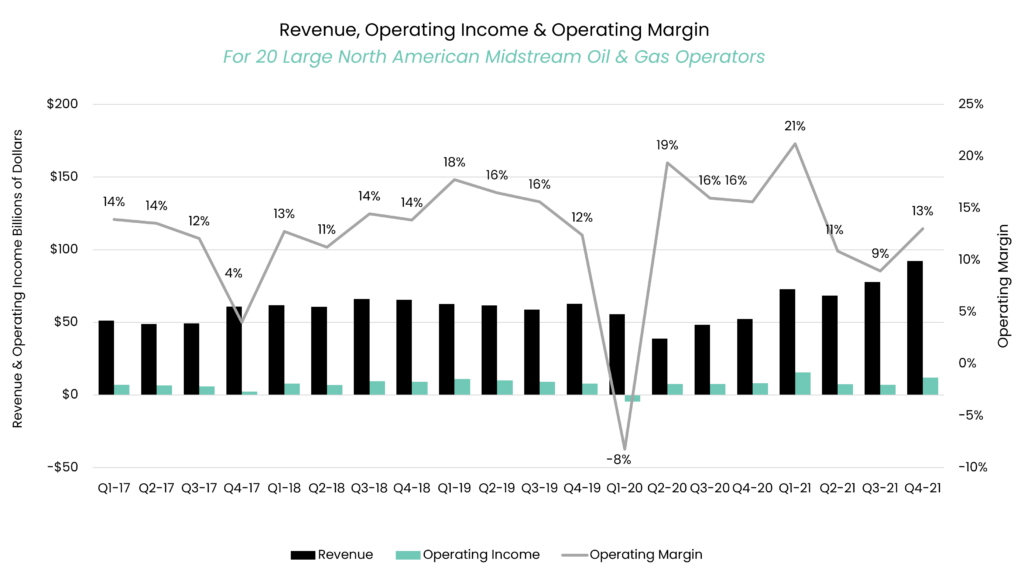

JT: There are a few key takeaways from this report. First, the midstream industry is not investing in its productive assets at the rate expected, given the current price of crude oil. As crude prices increase, upstream operators typically increase the level of oil production and extraction. This incentivizes midstream operators to invest in their equipment to ensure reliable operations and increase the throughput ability of their asset base. Capital expenditures have remained significantly below 2019 levels, even though crude prices are much higher. Second, midstream industry margins are being compressed; even though revenues have increased significantly, inflation and labor/equipment shortages have led expenses to increase more rapidly than revenues. This margin compression should lead midstream operators to focus intensely on improving operations and reliability. Lastly, some companies in our report should increase their reliability spend, while others likely have a significant amount of wasted reliability spend. Midstream companies should examine their reliability initiatives through a microscope to identify any wasted financial resources or to determine whether they are spending enough on reliability measures. A data-driven reliability approach can help to ensure that midstream resources are being utilized at an efficient and effective rate.

Q1 reports were recently published – have you seen any notable trends? Has the Q1 performance of these midstream operators differed from 2021 performance?

JT: The first quarter of 2022 continued the recent trend in both capital expenditures and operating margin for the midstream industry. The first graph below shows midstream capital expenditures and average WTI crude price on a quarterly basis. One of the key takeaways from the report is the deviation between normally-correlated midstream capital expenditures and crude price. At the current crude price, one would expect midstream operators to grow their asset base to facilitate increasing supplies of crude from upstream operators. However, production and extraction of crude oil have not been increasing; therefore, midstream operators have not been investing in their asset base as they typically have in the past. This could have long-term effects on the reliability of assets.

AL: The second graph shows revenue, operating profit, and operating margin from the 20 midstream operators. Following the peak operating margin in Q1 of 2021, margins have been compressing, mainly due to increasing inflation and higher labor/equipment costs. Even with increasing revenue, midstream companies are finding their margins being squeezed and this trend has continued into the first quarter of 2022.

Curious how your company compares to the top performers in the industry? Download our Economics of Reliability Report to find out.

Stay in the know.

Providing data-driven insights, perspectives, and industrial inspiration from the forefront of the reliability transformation.